There’s more to fire damage than meets the eye. Fire can also cause hidden damages that can be hard to detect. The two main culprits: smoke/soot damage, and water damage. Knowing about these additional impacts on your property, and how to take care of them, helps ensure you’re reimbursed appropriately for your claim.

As the homeowner, you’re responsible for clearing debris from your property after a fire. The good news is coverage for debris removal is included in most homeowners insurance policies. It’s a necessary expense to bring your property back to its pre-loss condition, but how much is available for the site cleanup and what debris is covered?

When a fire or other covered peril renders your home not fit to live in, your homeowners insurance policy likely provides Additional Living Expense/Loss of Use coverage that pays for temporary housing and other extra expenses you incur to maintain your standard of living. ALE also reimburses you for other expenses that rise above and beyond what you would normally spend.

One of the most daunting tasks required in the claim process after losing your home to a fire is properly documenting your personal property to ensure you’re compensated fully for what you’ve lost. Completing a total loss inventory list is a high-stress task, and it must be done correctly so as not to leave settlement dollars on the table. Know going in that it will be messy, time-consuming, and require a lot of patience as you meticulously document the many possessions you’ve accumulated over a lifetime.

The two terms “vacant” and “unoccupied” might appear to be synonymous, even interchangeable in general conversation, but they are distinctly different when it comes to property insurance coverage.

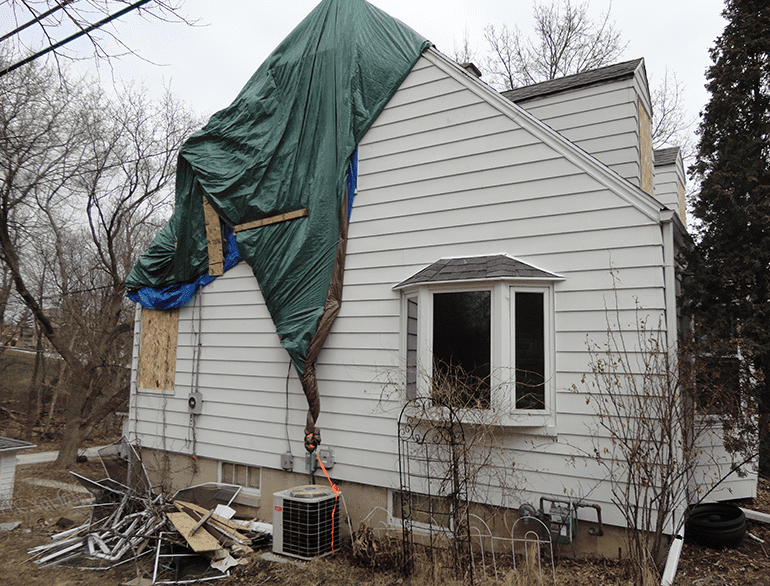

When a hailstorm strikes, it can batter roofs, shred screens and siding, and smash windows. Getting fully compensated for even glaring hail damage from your commercial, BOP or homeowners insurance policy is a challenge. Achieving a fair settlement for anything less than glaring damages can be a nightmare.

Major rain events — like the ones that have been plaguing Wisconsin this summer — get insurance companies busy denying homeowners insurance claims based on water-related policy exclusions.

Continuing the discussion about water damage insurance claims, Attorney Edward Beckmann, of Helmuth and Johnson, contributed the following guest posting about his favorite insurance law tongue twister: the anti-concurrent cause clause.

It is expensive to relocate your family while you're rebuilding your damaged home. You’ll incur hotel expenses, meals out and more. Fortunately, your Homeowners policy covers those extra expenses under "Coverage D - Loss of Use - Additional Living Expenses.” Your property insurance adjuster should explain this coverage, but he’s not likely to go into detail about some of the benefits to which you are entitled.

Your home insurance policy is written using simplified language, but policies still seem downright tricky at times. Unless you’ve spent a sizeable chunk of your leisure time sifting through your policy's agreements, definitions, and exclusions, you might not realize that these five items are actually covered.

When is The Right Time for the Appraisal Clause?

There’s more to fire damage than meets the eye. Fire can also cause hidden damages that can be hard to detect. The two main culprits: smoke/soot damage, and water damage. Knowing about these additional impacts on your property, and how to take care of them, helps ensure you’re reimbursed appropriately for your claim.

Building codes are in a constant state of evolution. Advancements in engineering, technology, safety, building materials and methods, and changes in the physical environment all drive changes in building codes. If your fire-damaged home is 10 or more years old, complying with the current building codes may add substantial cost to your reconstruction. Will you be stuck with the bill?

This expert’s guide will take you through the steps to manage your insurance claim from start to finish and help you maximize the settlement.

If I could provide one crucial piece of advice to anyone dealing with a major loss due to fire, water damage, etc. – it would be to contact Miller Public Adjusters!

“Excellent experience. I had a major fire which destroyed my business. My Insurance company was hostile and adversarial at best. I hired Miller Public Adjusters. They did everything. I never had to have another conversation with a elusive and hostile insurance company. If I hadn’t hired Miller Public Adjusters to represent me, I would’ve lost everything.”

“Dave is super knowledgable on the process as he’s not only been in the industry for years but he has also had personal experience with his own fire-damaged home. No matter how trivial you may think your question is Dave and his staff will take the time to make sure your questions get answered and you understand the ramifications. His expertise on the matter quickly turned what seemed to be a hopeless uphill battle into a more manageable playing field.

“Top-notch service would recommend Miller Public Adjusters service to anyone. Dave thank you much. The process was great.”

“David and his staff are outstanding and worth their weight in gold. If you need help with any insurance claim, hire them; you’ll be glad you did! If I could rate them 100 stars, I would!”

"Champions. Warriors. Heroes. Lifesavers! That’s exactly what David Miller and his fantastic team at Miller Public Adjusters are! There really are no words to describe what his team has done for me and my family. We are extremely grateful, and they are WORTH EVERY SINGLE PENNY you pay them for their services and then some!"

“Thankfully, the restoration company referred us here. From that point on, David at Miller Public Adjusters reassured us that he would do everything in his power and knowledge to prove that our homeowners insurance should cover the damages. In the end, we won the case and the claim was paid. I can’t thank David at Miller Public Adjusters enough!”

We never would have been able to navigate the confusing world of a total loss claim without their help, guidance and expertise,” Todd stressed. “I would recommend Miller Public Adjusters to anyone who is faced with a traumatic claim that involves dealing with ‘Big Insurance.’ They will absolutely help to alleviate much of the pain.

They were successful at getting the maximum settlement from the insurance company. My family and I are always praising Miller Public Adjusters to people who ask us about the fire. We can’t thank them enough.

“Miller Public Adjusters knows what they are doing and stood firm against the insurance company. Miller Public Adjusters got us everything we were entitled to, and even more than we thought, in a matter of months. We did not have to deal with our insurance company and also did not have to purchase anything and turn in receipts for reimbursement. What a time-saving relief. Miller Public Adjusters are knowledgeable, understanding professionals, and we highly recommend them to all our friends and family.”

At just a month into Fall, some Wisconsinites already shoveled snow, many are past the first frost,

At just a month into Fall, some Wisconsinites already shoveled snow, many are past the first frost,

At just a month into Fall, some Wisconsinites already shoveled snow, many are past the first frost,

E-mail address

Contact us

Money-back