Here is a scenario that occurs more often than you might think.

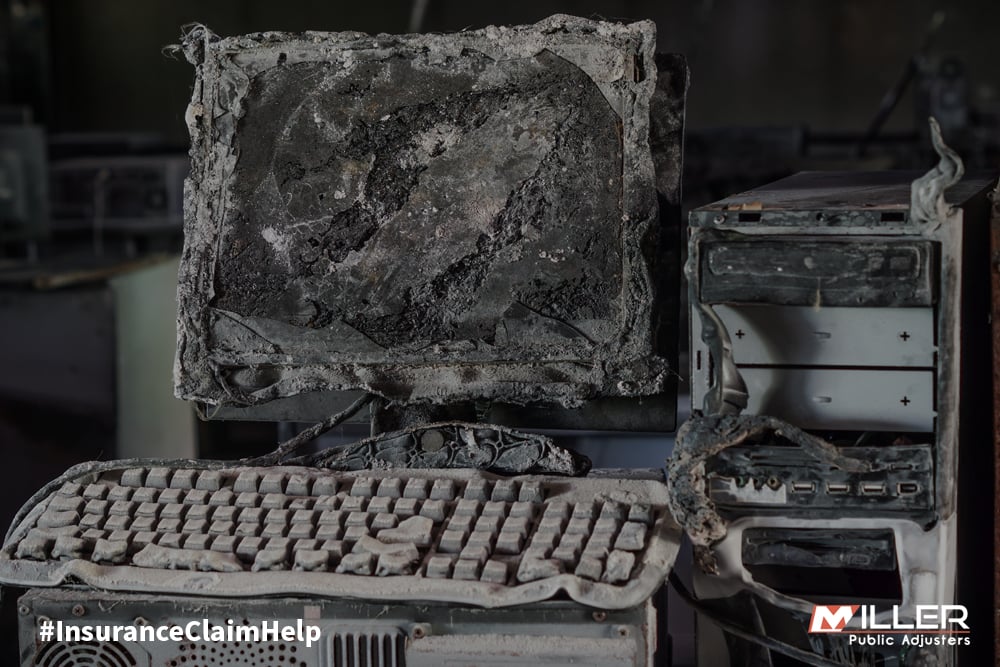

You’ve had a fire in your home, severely damaging the structure as well as contaminating most of your personal property with smoke/soot damage and odor. Upon meeting with the insurance company’s claims adjuster assigned to your case, he recommends a cleaning and restoration contractor to remove your belongings, and the contractor starts spending your claim dollars on cleaning the property they deem salvageable.

What’s wrong with this picture? Let me count the ways.

First off, the fact that the adjuster recommends a single contractor should set off an immediate red flag. It is simply not ethical for a company’s claims adjuster to recommend a single approved contractor. It calls into question many things, such as the prior relationship between the contractor and the company, and whether the contractor works in the best interest of the insurer or the insured.

The adjuster should provide a list of restoration contractors to choose from. And remember, you don’t have to use any recommended firms from the insurance company. You have the right to hire your own contractor. It’s your home, your decision.

Second, we’ve frequently come into situations where the cleaning and restoration contractor has already started work before reaching an agreement on the price and gaining approval of the insured. Who gave them the green light? Slow down, there is no reason to rush into a decision or feel pressured to do anything until you’ve had a chance to examine the specifics. Get any and all cleaning prices and detailed inventories of cleanable items upfront.

Third, before approving that $50,000 quote to clean your personal belongings, stop and think for a second: Do you want to pay a company to take your smoky, smelly, soot-damaged belongings and attempt to clean them? Will they ever be as good as they were?

The insurance company owes the price to clean the items whether you decide to clean them or not, so it may make more sense (and usually does) to receive the money instead. Cleaning your property items also affects the limits of your policy’s Coverage C – Personal Property coverage, so if you spend $50,000 on cleaning, you’re left with fewer overall dollars to replace your non-salvageable items.

Another consideration: The vast majority of money spent on restoration is pure profit for the contractor. In fact, they aim for a 65 to 70 percent minimum profit margin. At Miller Public Adjusters, we usually recommend cleaning or restoring only those items that have sentimental value, then acquiring the maximum RCV (replacement cost value) settlement dollars available under Coverage C. This ensures more effective use of your claim settlement rather than enhancing a contractor’s balance sheet.

Remember, don’t allow a contractor to touch your damaged personal property until you have an opportunity to examine it yourself. For example, say you have a 25-year-old file cabinet you purchased new for $100. After depreciation, actual cash value (ACV) would be almost negligible, but a comparable file cabinet purchased today would run about $250, and your policy provides replacement value. It’s a no-brainer.

That goes for clothing, too. If it would cost $25,000 to clean damaged clothes, perhaps those funds could be better used by replacing your clothes yourself.

Miller Public Adjusters proudly serves policyholders in

Wisconsin, Illinois, Indiana, Michigan, Minnesota, Texas and Florida.

Call us 24 hours a day at 866-443-5167 to schedule a consultation, or you can request a Free Claim Review to see how we can help.

.png)