When you hire a public adjuster you’re bringing in a licensed, trained, educated, and experienced professional to help you contend with your property loss. A qualified public adjuster understands the claims process much more than the average homeowner and can be your best advocate, as his or her only goal is protecting your interests.

When to Hire a Public Adjuster

When you suffer a large property loss, you may require professional help to make certain you receive your full insurance claim settlement. Because public adjusters are highly experienced in dealing with claims and insurance company adjusters, they can be extremely helpful in both maximizing your claim and avoiding delays with your recovery. Your insurance company has experts protecting their interests and you are entitled to the same.

You can bring in a public claims adjuster at any point from the moment of loss to after your claim has been paid or denied, unless the statute of limitations has passed. Here are the top five reasons a public adjuster will most likely negotiate a better settlement claim than if you handle it yourself.

Expert Adjusters

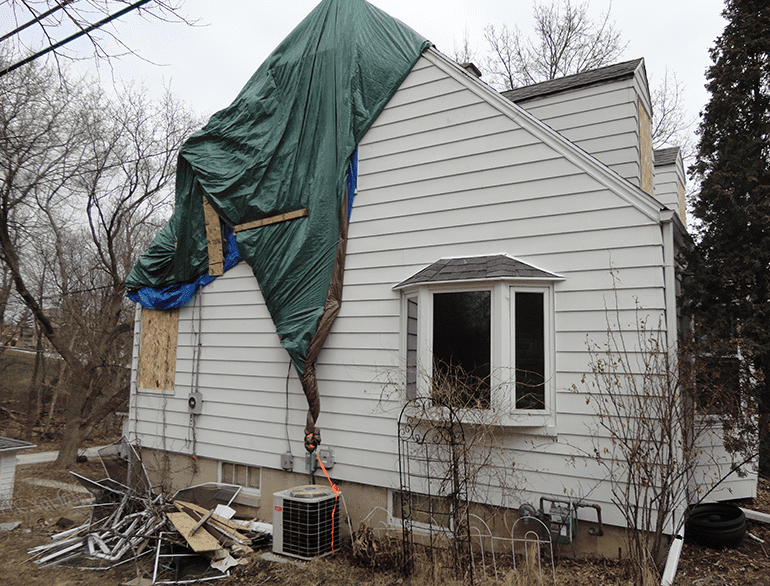

Once the impact of the emergency has been dealt with, a public adjuster will expedite the claims process by immediately notifying your insurance company of your loss. While inspecting your property and compiling your claim, the adjuster will probably add dozens of items that you may have overlooked or didn’t realize were covered by your policy. Experience teaches public adjusters how to accurately value your loss based on quality of materials, craftsmanship, condition and inflation.

Damage Analysis

Public adjusters are generally more complete in their damage analysis than the homeowner or insurance company adjusters are. They are trained to identify every possible covered claim and provide you with a personalized service focused on getting you every dollar you deserve. You can count on them to do so, because they do not receive their fee until you, the policyholder, receive your claims reimbursement. The public adjuster is paid a percentage that is approximately between 5 - 10 percent of the settlement received.

Negotiation Pros

When you hire a public adjuster, you hire an expert who has the tools and knowledge to tip the settlement scales in your favor. Remember, insurance company adjusters are looking for ways to reduce your claim. An experienced public adjuster won’t let that happen.

Software Programs

Public adjusters have access to the same software insurance companies use when determining your claim, but don’t apply the “one size fits all” process to your claim like your insurer does. A public adjuster will use estimating software as one tool to fully and accurately reflect your loss.

It’s in the Details

Public adjusters are experts at reading the fine print. Not many people have read their entire insurance policy, but your public adjuster will. Based on your policy’s provisions, your public adjuster will handle details like building estimates, loss-of-use receipts, and content spreadsheets, allowing you to concentrate on rebuilding your home.

A reputable public adjuster handles and prepares claims every day and can do a more thorough and competent job than a homeowner who may have only one loss in their lifetime. Public adjusters know what is rightfully due to you, and their passion is in obtaining it. The decision to hire such a powerful advocate to handle your claim can turn out to be a bright spot in an often confusing and trying process.

Miller Public Adjusters currently serves the states of

Wisconsin - Florida - Illinois - Indiana - Michigan - Minnesota - Texas

Call us 24 hours a day at (866)443-5167 to schedule an appointment or

please fill out a Free Claim Review to see if we can help.

.png)