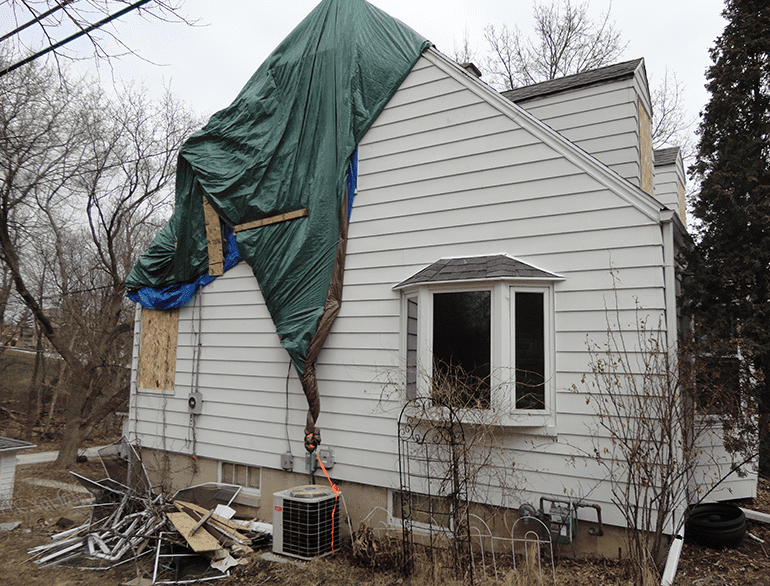

Hiring a public adjuster to handle your property damage claim makes a difficult time much less stressful and has a direct impact on how much you ultimately collect from your insurer. The claims adjusters who work for your insurer are highly-trained professionals who determine how much your covered loss is worth. Keep in mind, though, that they make their determination from the insurance company’s perspective. A public adjuster represents your interests and has one objective: to obtain the best settlement possible for you.

A Better Approach

If you believe you’re entitled to a higher insurance settlement, hiring a public adjuster can be a smart choice. Here are the top five reasons you should hire a public adjuster instead of managing your own insurance claim.

1. They Work Exclusively for You

Public adjusters understand everything there is to know about the insurance industry and can analyze your insurance policy down to the finest details. Throughout your claim process, they uphold your rights and negotiate with your insurer to get you a higher insurance settlement in a timely and effective manner.

2. No Upfront Fees

There are no out-of-pocket expenses when hiring a public adjuster. They don’t get paid until a settlement has been reached, at which time they receive an agreed-upon percentage of your settlement, typically 10%

3. Higher Insurance Settlement

A public adjuster is in the business of ensuring you receive the largest settlement possible under your policy and will fight to get you’re the maximum payout you deserve. Public adjusters know all the ins and outs of insurance policies and the ways in which insurance companies evaluate your claim. If you wonder whether a public adjuster can actually get you more for your claim, keep in mind that, on average, homeowners receive 25% to 40% more money when an adjuster is involved.

4. Public Adjusters Dig Deeper

Insurance companies depend on homeowners not fully understanding their policies and what types of damages they can claim. Many public adjusters have worked for insurers and know exactly what to look for in your policy so that they can make a claim for all the damages you qualify for. Your public adjuster can also discover issues the insurer’s adjuster missed.

5. Public Adjuster Get Faster Results

Insurance companies are famous for dragging their feet when dealing with claims. Public adjusters know the claims process inside out and will help you get your settlement in a timely and efficient manner, allowing you to repair or rebuild your home and move on with your life. Homeowners who handle the claims process themselves are often overwhelmed by the amount of paperwork involved. Public adjusters know what documentation to submit, minimizing the chances of the insurance adjuster coming back with requests for more information. They’ve been through the process many times and understand the common hold-ups and how to prevent or cope with them.

Conclusion

Filing a property damage claim is a drain on your time, resources and sanity. If you feel your insurance company is not taking your claim seriously, or it refuses to pay for your losses, you want a capable and experienced public adjuster on your side. Your claim does not need to be very large for you to hire professional help. The truth is, if your claim approaches $10,000 or higher, you can benefit from hiring a public adjuster, and it would be well worth your while to seek professional help.

Miller Public Adjusters currently serves the states of

Wisconsin - Florida - Illinois - Indiana - Michigan - Minnesota - Texas

Call us 24 hours a day at (800)958-4829 to schedule an appointment or

please fill out a Free Claim Review to see if we can help.

.png)