When your home is damaged due to a fire or other insured peril, you have a lot of tasks to accomplish to get your home back to normal. You must restore or replace your personal property, find a contractor to repair your home and work with the insurance company adjuster to settle your claim and resolve any coverage issues. A public adjuster helps you through the claim process, but is that your best option?

What is a Public Adjuster?

A public adjuster performs many of the same tasks as the insurance company property adjuster, but there are a few differences between the two. The insurance adjuster is paid and controlled by the insurance company while a public adjuster works for you. The insurance adjuster protects his employer’s financial interests. Your public adjuster handles the claim on your behalf and protects your interests.

Many public adjusters come from insurance claim backgrounds. They have the same training and skills as company adjusters and the ability to handle all facets of your homeowners property claim.

- Review policies and address coverage issues

- Calculate building and personal property damages

- Review contractor estimates

- Evaluate claims

- Assess supplemental damages

- Negotiate claim settlements

Do you need a public adjuster?

A public adjuster has the expertise and experience to handle the endless stream of property claim details. Hiring your own adjuster takes the heavy claim burden off your shoulders, but there are some circumstances where you might not need the assistance. Here are a few things to consider before making the decision.

What is the extent of the Damage?

When your damage is minor, your property claim is easier to conclude without assistance. Because the insurance company's potential payment is less, damage or restoration complications are minor and easier to work through.

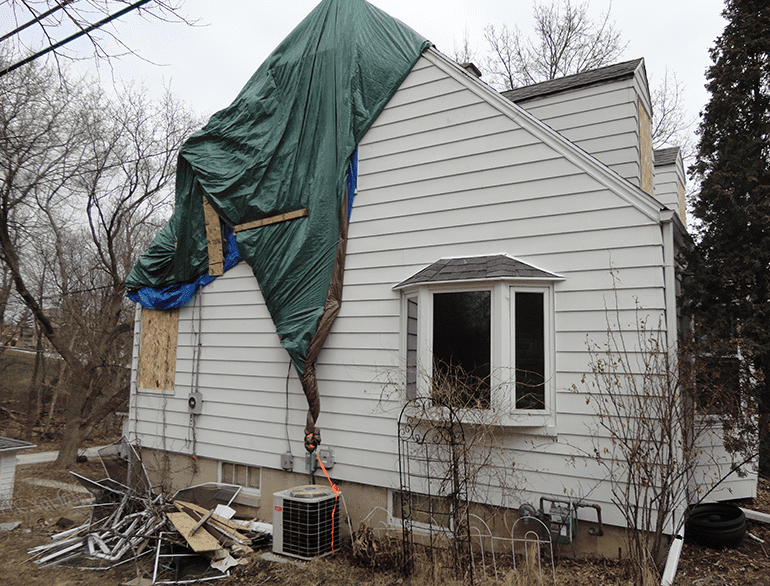

If your home sustains catastrophic damages, claim-related tasks get very complicated very quickly.

- Higher possibility of error in calculating your damages

- Potential for repair problems

- Higher probability of underpayment

- Greater potential for delayed settlement due to ongoing insurance company investigation

If you’d prefer not to handle these challenges, you should consider hiring an experienced professional to deal with your insurance company and contractors.

Are there coverage issues?

When an insurance company determines there are coverage issues, the company adjuster advises you either formally or informally.

- Explains the issues by phone or in person

- Withdraws from handling your claim without explanation

- Issues a reservation of rights letter or insist that you sign a waiver so they can continue to investigate your claim without a commitment to pay

- Sends a coverage declination

When you have unresolved coverage issues, you need an insurance professional on your side with the insurance policy expertise to resolve them.

Do you feel like you need help?

If you have confidence in your ability to manage all the property claim details and you have the time to do it, you might feel more comfortable handling your claim on your own. There may uncertainty that will make hiring a professional a more attractive option.

Are you satisfied with your insurance company’s performance

It’s possible that your insurance company will meet your claim expectations without a hitch. Whether or not the damage is extensive, if you are pleased with the way the company adjuster is handling your claim, you might not have any reason for bringing in your own representative.

Hiring a public adjuster is your choice

It’s good to know that you have options. You can choose to resolve your claim directly with your insurance company's adjuster, but you change your mind at any time and hire a public adjuster to assist you. The choice is yours.

Miller Public Adjusters currently serves the states of

Wisconsin - Florida - Illinois - Indiana - Michigan - Minnesota - Texas

Call us 24 hours a day at (800)958-4829 to schedule an appointment or

please fill out a Free Claim Review to see if we can help.

.png)