When is The Right Time for the Appraisal Clause? Are you at a settlement impasse with your insurance company? ...

From pre loss to post recovery, homeowners and commercial insurance policyholders rely on Miller Public Adjusters for expert property insurance claim service.

The best time to consider how your homeowners or commercial insurance policy will respond to a fire, storm, water, or other loss event is before you need to file a property damage insurance claim.

Miller Public Adjusters can help with a:

If your coverage falls short of the protection you need, we’ll explain why and how to fix it. If you suffer a loss, you’ll have both the coverage and documentation you need to achieve a full and fair settlement.

As licensed public insurance adjusters, our property claims experts work exclusively for residential and commercial insurance policyholders — never for insurance companies. From the moment Miller Public Adjusters takes on your claim, our mission is to:

For additional information, including frequently asked questions about public adjusting, please visit our page, What is a Public Adjuster?

Claim disputes arise frequently over the valuation of damages. Often, these disputes can be resolved by providing additional evidence of value, further negotiation, or mediation. Sometimes, though, the only way to reach agreement about the value of a claim is by invoking your right to appraisal.

Virtually all homeowners and commercial insurance policies include the right to have the value of a loss determined through the appraisal process. Your policy likely includes language like:

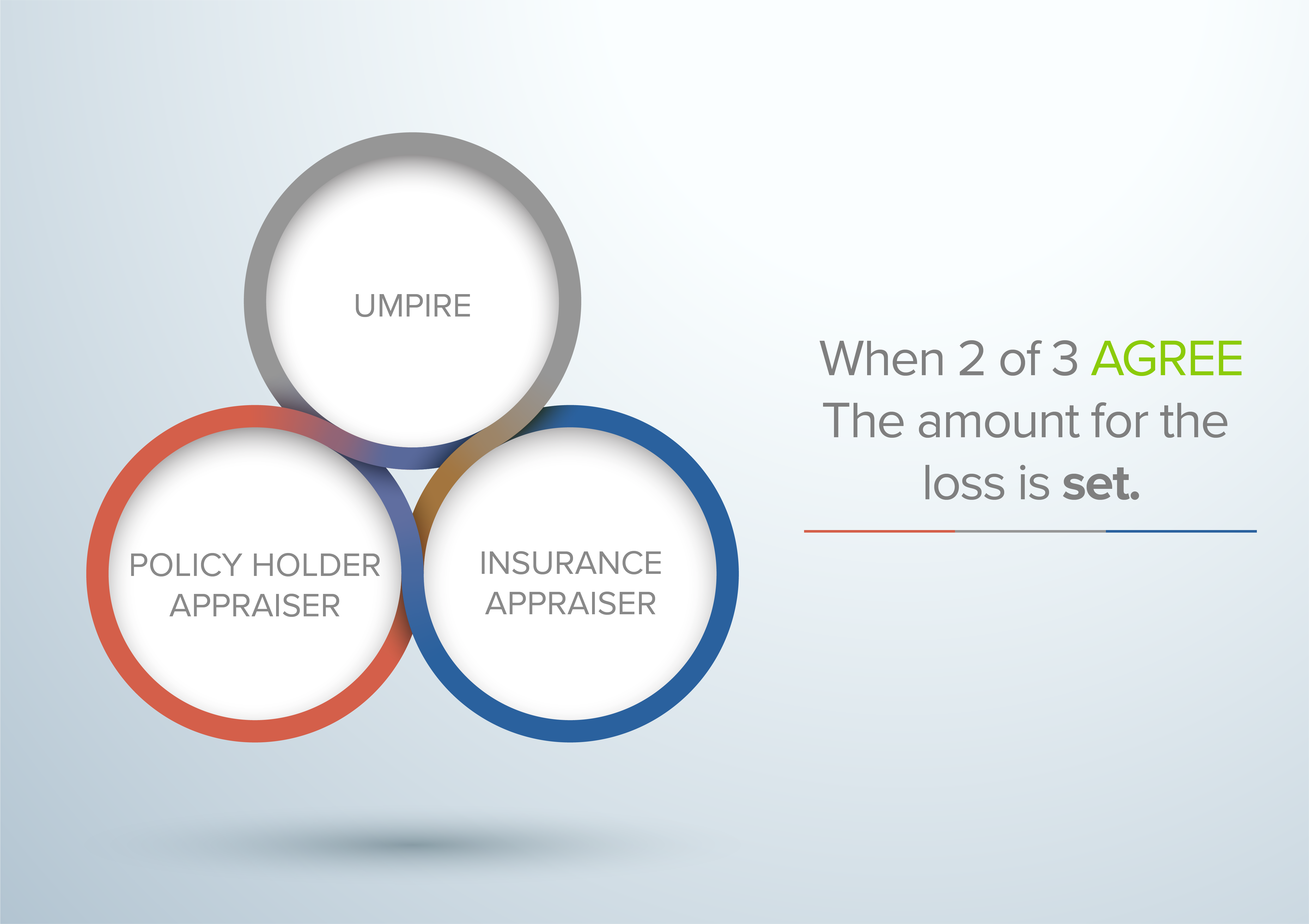

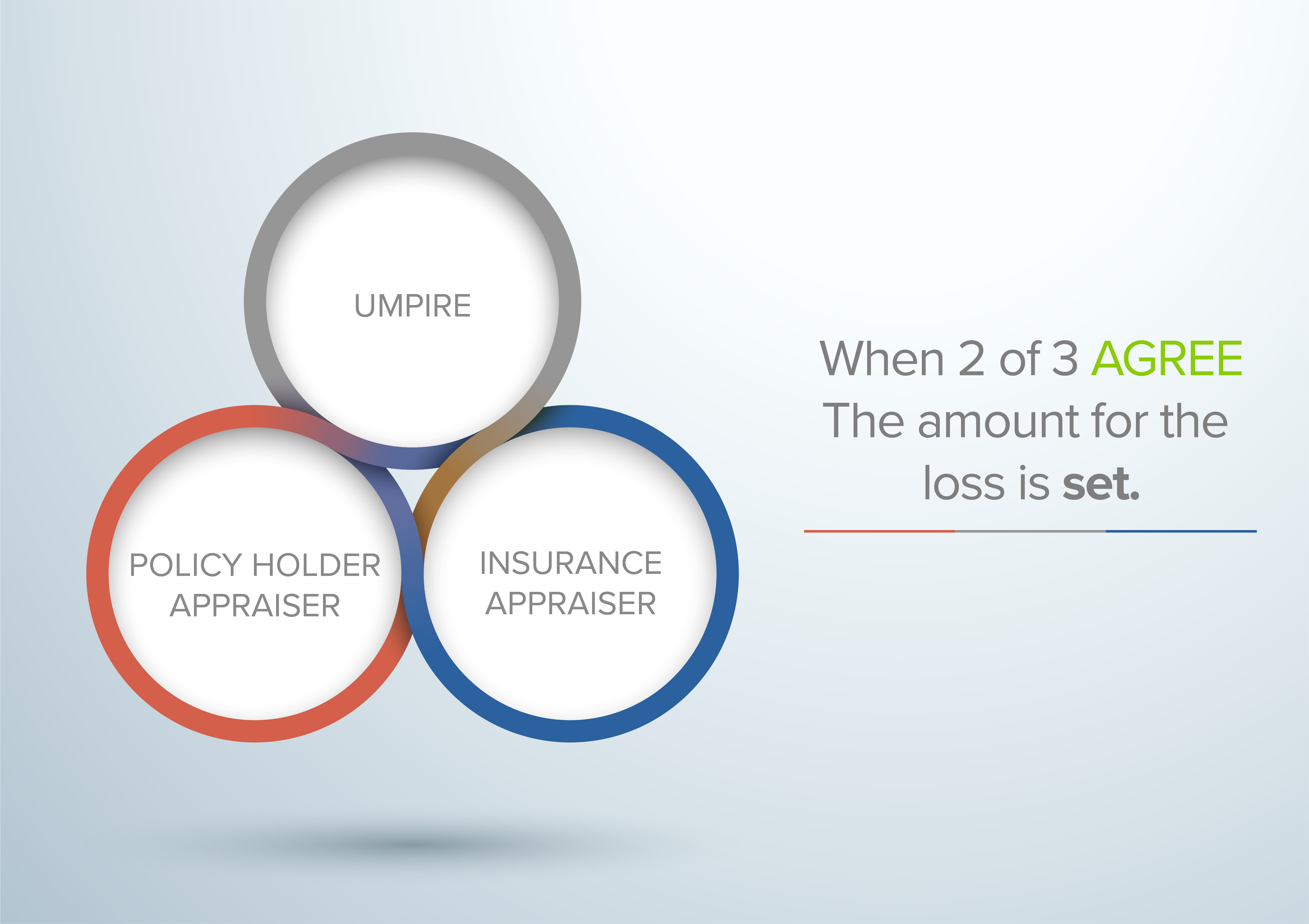

“If you and we fail to agree on the amount of loss, either may demand an appraisal of the loss. In this event, each party will choose a competent and impartial appraiser within 20 days after receiving a written request from the other. The two appraisers will choose an umpire. If they cannot agree upon an umpire within 15 days, you or we may request that the choice be made by a judge of a court of record in the state where the [property] is located. The appraisers will separately set the amount of loss. If the appraisers submit a written report of an agreement to us, the amount agreed upon will be the amount of loss. If they fail to agree, they will submit their differences to the umpire. A decision agreed to by any two will set the amount of loss.”

As you can see, either you or your insurance carrier can move your claim to appraisal — though only after other efforts to reach agreement have been exhausted. Once appraisal is invoked, the clock starts ticking, and the outcome is binding. That’s why it’s critically important to hire an appraiser with a reputation for being thorough, efficient and fair when setting loss amounts.

Experienced public adjusters are regularly brought in to serve as appraisers. We have the resources and training to unravel the complexities of the policy language, and the expertise to scope the loss and arrive at a fair settlement amount.

It is important to note, the appraisal process is used only to resolve disputes about the scope of a loss or the value of a claim. It is not used to address coverage concerns, delays, denials, etc. A public adjuster can be invaluable in those circumstances, too. A public adjuster cannot represent a policyholder and serve as his or her appraiser on the same claim.

During the appraisal process, the appraisers, both yours and your insurance carrier’s, have the opportunity to negotiate a fair value for your loss. If they can reach an agreement, they set the amount of your loss. If they cannot reach an agreement, the insurance umpire listens to and reviews both sides of the dispute. When any two — both appraisers, or one appraiser and the umpire — agree to a valuation, they set the amount for the loss.

The finality of the appraisal process underscores the need to choose your appraiser carefully. Recall the two appraisers select the umpire. Key factors for a successful appraisal include knowing:

Licensed public adjusters, like those at Miller Public Adjusters, routinely serve as insurance appraisers and umpires. We know the ins and out of insurance policies and the appraisal process. If you have questions, we have answers.

With a nationwide reputation for expertise in all aspects of property insurance policies, dispute resolution, and successful claims settlement, Miller Public Adjusters is often called on for expert witness and consultation in legal proceedings and court cases.

Complicated losses require deep expertise to sort out the cause(s) of loss, extent of damage, cost to replace or repair property, loss of use, additional incurred expenses, and other claim-related issues.

Miller Public Adjusters is routinely brought in to provide professional investigation, policy analysis, scope of loss, and fair valuation.

The best time to consider how your homeowners or commercial insurance policy will respond to a fire, storm, water, or other loss event is before you need to file a property damage insurance claim.

Miller Public Adjusters can help with a:

If your coverage falls short of the protection you need, we’ll explain why and how to fix it. If you suffer a loss, you’ll have both the coverage and documentation you need to achieve a full and fair settlement.

As licensed public insurance adjusters, our property claims experts work exclusively for residential and commercial insurance policyholders — never for insurance companies. From the moment Miller Public Adjusters takes on your claim, our mission is to:

For additional information, including frequently asked questions about public adjusting, please visit our page, What is a Public Adjuster?

Claim disputes arise frequently over the valuation of damages. Often, these disputes can be resolved by providing additional evidence of value, further negotiation, or mediation. Sometimes, though, the only way to reach agreement about the value of a claim is by invoking your right to appraisal.

Virtually all homeowners and commercial insurance policies include the right to have the value of a loss determined through the appraisal process. Your policy likely includes language like:

“If you and we fail to agree on the amount of loss, either may demand an appraisal of the loss. In this event, each party will choose a competent and impartial appraiser within 20 days after receiving a written request from the other. The two appraisers will choose an umpire. If they cannot agree upon an umpire within 15 days, you or we may request that the choice be made by a judge of a court of record in the state where the [property] is located. The appraisers will separately set the amount of loss. If the appraisers submit a written report of an agreement to us, the amount agreed upon will be the amount of loss. If they fail to agree, they will submit their differences to the umpire. A decision agreed to by any two will set the amount of loss.”

As you can see, either you or your insurance carrier can move your claim to appraisal — though only after other efforts to reach agreement have been exhausted. Once appraisal is invoked, the clock starts ticking, and the outcome is binding. That’s why it’s critically important to hire an appraiser with a reputation for being thorough, efficient and fair when setting loss amounts.

Experienced public adjusters are regularly brought in to serve as appraisers. We have the resources and training to unravel the complexities of the policy language, and the expertise to scope the loss and arrive at a fair settlement amount.

It is important to note, the appraisal process is used only to resolve disputes about the scope of a loss or the value of a claim. It is not used to address coverage concerns, delays, denials, etc. A public adjuster can be invaluable in those circumstances, too. A public adjuster cannot represent a policyholder and serve as his or her appraiser on the same claim.

During the appraisal process, the appraisers, both yours and your insurance carrier’s, have the opportunity to negotiate a fair value for your loss. If they can reach an agreement, they set the amount of your loss. If they cannot reach an agreement, the insurance umpire listens to and reviews both sides of the dispute. When any two — both appraisers, or one appraiser and the umpire — agree to a valuation, they set the amount for the loss.

The finality of the appraisal process underscores the need to choose your appraiser carefully. Recall the two appraisers select the umpire. Key factors for a successful appraisal include knowing:

Licensed public adjusters, like those at Miller Public Adjusters, routinely serve as insurance appraisers and umpires. We know the ins and out of insurance policies and the appraisal process. If you have questions, we have answers.

With a nationwide reputation for expertise in all aspects of property insurance policies, dispute resolution, and successful claims settlement, Miller Public Adjusters is often called on for expert witness and consultation in legal proceedings and court cases.

Complicated losses require deep expertise to sort out the cause(s) of loss, extent of damage, cost to replace or repair property, loss of use, additional incurred expenses, and other claim-related issues.

Miller Public Adjusters is routinely brought in to provide professional investigation, policy analysis, scope of loss, and fair valuation.

This expert’s guide will take you through the steps to manage your insurance claim from start to finish and help you maximize the settlement.

When is The Right Time for the Appraisal Clause? Are you at a settlement impasse with your insurance company? ...

There’s more to fire damage than meets the eye. Fire can also cause hidden damages that can be hard to detect....

Building codes are in a constant state of evolution. Advancements in engineering, technology, safety, building...

E-mail address

Contact us

Money-back