Hiring a public adjuster for insurance claims helps you protect your payout. It also avoids costly mistakes an...

Nemo nibh condimentum autem ligula ultricies velit sociosqu eos voluptatibus modi porttitor natoque proin proident Facilisis dapibus convallis molestie.

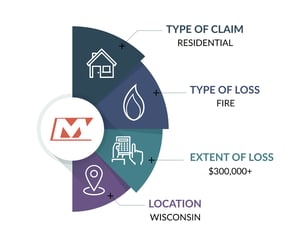

It started out as a pretty typical day for our family, other than the new craftsman-style front porch a contractor was working on for us. Our contractor was not at the house as we were getting ready in the morning, but we looked forward to seeing his progress when we got home later that afternoon. We got our daughter off to school, my fiancé went to work, and I was off to my doctor’s appointment. (We were expecting our third child in a few months.) We were thrilled to be expecting a little boy; the previous day was the first time he cooperated with the ultrasound technician so we could get a few images of him. I had those ultrasound photos sitting on the kitchen table so I would remember to grab them to show my co-workers…but I forgot them! As luck would have it, those images would be among the few recoverable items from the devastating house fire that occurred that day! In the early afternoon, I was on a conference call at work. My fiancé was calling me over and over again, but I wasn’t able to answer the phone. A friend of mine frantically tried to reach me during that time as well. Long story short, my fiancé, concerned friends and neighbors were frantically trying to reach me and let me know my house was on fire! When I got the bad news, I left work immediately and headed home.

It started out as a pretty typical day for our family, other than the new craftsman-style front porch a contractor was working on for us. Our contractor was not at the house as we were getting ready in the morning, but we looked forward to seeing his progress when we got home later that afternoon. We got our daughter off to school, my fiancé went to work, and I was off to my doctor’s appointment. (We were expecting our third child in a few months.) We were thrilled to be expecting a little boy; the previous day was the first time he cooperated with the ultrasound technician so we could get a few images of him. I had those ultrasound photos sitting on the kitchen table so I would remember to grab them to show my co-workers…but I forgot them! As luck would have it, those images would be among the few recoverable items from the devastating house fire that occurred that day! In the early afternoon, I was on a conference call at work. My fiancé was calling me over and over again, but I wasn’t able to answer the phone. A friend of mine frantically tried to reach me during that time as well. Long story short, my fiancé, concerned friends and neighbors were frantically trying to reach me and let me know my house was on fire! When I got the bad news, I left work immediately and headed home.

When I approached my neighborhood, the street was completely closed off. I parked on an adjacent street and started walking towards my house. All I could focus on was fire truck after fire truck lining the street–eight in all. The trees were so tall that I still could not see my house. I heard my friend call my name, and she was running towards me with outstretched arms. As we got closer to my house, the firefighters were in the process of cutting ventilation holes in the roof, with fire and heavy smoke pouring out. It was truly a heartbreaking moment. I can’t explain what goes through your mind as you watch your house burn down. I wasn’t thinking about our furniture, I wasn’t thinking about my closet full of clothes and I wasn’t thinking about my appliances. I was thinking about the memories we made in that house, the good and bad moments that we lived out together there, and the new memories we looked forward to creating with our new son. I didn’t want my jewelry; I wanted the handwritten letter my grandmother wrote to me shortly before she passed. That house was not a number or an amount to me; it was so much more. That house was where we built our family, where we said our prayers each night, where we proudly hung Mother’s and Father’s day pictures in our kitchen.

While the house was still smoldering, my insurance adjuster showed up. At that point, the shock was fully set in. I was handed paperwork and signed it. I was handed more paperwork and I signed those too, but my head was not there; I was still in shock.

I saw my insurance adjuster shaking hands with people and then walking them over to me to make an introduction. Words were being used that I was in no way ready to process, and more paperwork was being signed. We left our house once it was boarded up and went to my parent’s house to tell our daughter what had happened. Her tears flowed like a fire hose after she found out her pink blanket from Auntie Sofia was gone—the one that had gotten her through seven years of thunderstorms and bad dreams. Losing that one little blanket flipped her world upside down, and I still get emotional when I think about that moment.

The next day we had work to do. We met with our adjuster as well as several different restoration companies, all bidding on the opportunity to contract with us for a series of tasks like cleaning our possessions, remediation, rebuilding, etc. Our insurance adjuster was running the show for us, and we let him. After all, he was our adjuster; he had to have our best interest in mind, right?

We were informed about the good restoration companies versus the bad ones, timelines were thrown out, hugs were given, and we were told we were in good hands; just trust the insurance company.

We went through a series of processes over the next couple of weeks. All items that could not be cleaned were inventoried and amounts were attached to them. Clothing that was not destroyed was sent off in an attempt to be cleaned. Slowly but surely, our lives were moving forward.

And all of a sudden, the work stopped…and our insurance company started to show its true colors in the ensuing “We have to talk” conversations.

There is so much that happens during the insurance claim process to go into details, but just know that we went in a bit naïve and blind, and we nearly paid dearly for that. The stress was compiling, and I was starting to get worried about my pregnancy, but we still pushed on.

We then got to the point of discussing the restoration of the house. Then came the shocking news: We would need to pay between $8,000 and $11,000 out of our own pockets to get that process started. The insurance company wanted us to pay money to rebuild our house that someone else caused to burn down. (The contractor was determined to have caused the fire.)

We received the company’s “interpretations” of our Homeowners policy and why the cost of the remediation process would not be covered. An interpretation is all it was; the insurance company wanted me to read the policy the way they needed me to read it to protect their own pocketbooks.

At this point, I broke down. We couldn’t afford to pay those costs, nor did we feel it was our responsibility to do so. After all, wasn’t the fire due to the contractor’s negligence? His insurance policy is obligated to pay, isn’t it? No longer able to handle the stress and misguidance from my insurance company, we needed some intervention. I got out my laptop, logged online and started to look for help.

In browsing to find some sort of proxy to help with my house fire, I discovered the Miller Public Adjusters website. Their business scope was exactly what I was looking for: I needed someone well-versed in reading insurance policies, someone who could handle all of the paperwork and “heavy lifting,” and someone to simply “go to bat” for me and be on my side.

We met with owner David Miller and discussed his services, our claim, and our common experiences; you see, David is not only an advocate for fire victims, but he is also a fire victim himself. Finding out that David has felt our pain firsthand convinced me that I needed to work with him. From the moment we shook hands, David took off running with my claim. The insurance company’s adjuster could no longer pull the wool over my eyes due to my lack of knowledge about insurance policies because David would not let them get away with it. He held the company accountable to deliver what I had been paying my premiums for.

My house was eventually deemed unsuitable to remodel so the city ordered it to be torn down. With that new and complicated component added to the mix, Miller Public Adjusters took the lead and ensured that my policy proceeds paid me what was required to rebuild. And the landscaping. And the concrete work. And just about anything else that, even though escaped my mind, Miller Public Adjusters were all over for me!

I don’t know whether my family could have survived this ordeal and come out whole without the help of David Miller. Thanks to him and Miller Public Adjusters, our newly expanded family is now safely in our newly rebuilt home making new memories with a bright future ahead of us!

If I could provide one crucial piece of advice to anyone dealing with a major loss due to fire, water damage, etc. – it would be to contact Miller Public Adjusters!

Hiring a public adjuster for insurance claims helps you protect your payout. It also avoids costly mistakes an...

A licensed public adjuster helps you deal with your insurance company and fights for a fair payout. Choose the...

The fastest way to maximize your insurance claim is to work with a public adjuster. Instead of struggling thro...

Join over 25,000 in beating the failure of strategies by following our blog.

At just a month into Fall, some Wisconsinites already shoveled snow, many are past the first frost,

At just a month into Fall, some Wisconsinites already shoveled snow, many are past the first frost,

At just a month into Fall, some Wisconsinites already shoveled snow, many are past the first frost,

E-mail address

Contact us

Money-back

600 S Nicolet Rd. Suite A

Appleton, WI 54914