Hiring a public adjuster for insurance claims helps you protect your payout. It also avoids costly mistakes an...

Nemo nibh condimentum autem ligula ultricies velit sociosqu eos voluptatibus modi porttitor natoque proin proident Facilisis dapibus convallis molestie.

One of the most important elements to successfully settling your property damage insurance claim is going through each step of your claim process with your eyes wide open.

Your insurance company’s representatives use a well-rehearsed process to settle property claims. Be sure, their process is not about making you whole. Their process is about reducing claim costs and protecting corporate profits.

Making sure you receive a full and fair settlement for your property insurance claim is your job. Keep reading for insight into the property claims process and help breaking your property damage insurance claim into more manageable pieces.

No two insurance policies are alike. Whether you have residential or commercial insurance, your policy was written specific to your property and its covered risks (also referred to as perils). Before you have any hope of making a full recovery for your damages, you must know your:

This means you must read and understand your policy. The language in your policy and how it applies to your loss is all that matters when you need to file a property damage insurance claim.

All commercial and homeowners insurance policies include verbiage that details both the insurer’s and the insured’s duties after a loss. Carrying out your duties within the required time frames is your responsibility. Failing to meet your obligations can give your insurance company cause to delay or deny your claim.

Some of the duties you must perform immediately following a loss include, but are not limited to:

Protect Against Additional Damage

When you suffer property damage, your insurance policy requires you to take steps to mitigate against additional damage. This could mean boarding up windows and doors, tarping your roof, drying out a floor —whatever reasonable emergency repairs may be needed to prevent additional damage from occurring. This is a no-excuses obligation. Coverage for professional mitigation service is included in most policies.

Provide Prompt Notification of Your Loss

Insurance companies all have toll-free claim reporting telephone numbers that operate 24/7/365. When you suffer damage to your home or commercial property, you should call the number and report your loss as soon as you are able. If you have an insurance agent, you should notify him or her, as well. Be aware many agents' hands are tied when a loss occurs, as the insurance carrier usually wants complete control of the claim process.

When you report your loss, provide truthful information, always. Refrain from speculating about anything you don’t personally know to be fact.

While providing prompt notification is a policy requirement, most policies do not define the word “prompt” in their notification requirements. There are time limits on how long you have to file a claim after you suffer a loss. Often it’s a year, sometimes two. The further removed you get from the date of loss, however, the more challenging it can be to prove the full extent of your damages.

Even if you only think you have property damage — for example, a severe hail storm pummeled your area — call your insurer, open a claim, and get a claim number. If it turns out you don’t have any damage, or the damage is less than your deductible, you can close your claim at any time without question or penalty from your insurer.

Allow a Thorough Investigation of Your Damages

Your insurance policy gives your insurance carrier the right to investigate any damages you report. They have an obligation to conduct their investigation efficiently, and you have an obligation to let them. Aside from any mitigation work, you should leave your damaged property unchanged until your insurer notifies you, in writing, that they have concluded their initial investigation.

It is common for insurance companies to use additional investigative measures, including observation, background checks, social media monitoring, and more. You could even be asked to submit to an Examination Under Oath (EUO). This is a legal proceeding where your sworn testimony to the facts of your claim is gathered and entered into the record. If you’ve been called to submit to an EUO, you should consider hiring professional representation to be there for your own protection.

If you've suffered business interruption losses, expect additional investigation into your business records, operations, etc. Policies vary on how far back an investigation can look. Time frames can be up to 10 years.

There are rules that govern what can and cannot be done during an insurance investigation. Knowing your rights — what you must permit, and what you don’t have to do — is critical. If you feel like your insurance company is misusing its right to examine your loss, don’t hesitate to seek advice from one of our public adjusters.

Cleaning up after a disaster is an important milestone in the recovery process. It’s only after the destruction and debris are gone that most people feel like they’ll recover from the loss one day.

But cleaning up also destroys the evidence of your loss. Before you or anyone moves or removes anything from your property, make sure you document your damages:

NEVER throw out any of your damaged property — even if it’s obviously totally destroyed — until you’ve documented the damage AND your insurer agrees the item(s) can be discarded.

To scope your loss means to identify the:

A thorough scope typically includes photographs of the property and damages, diagrams, and a detailed estimate for all of the work needed, broken down by construction trades and materials.

It’s important to reach agreement with your insurance carrier about the scope of your loss and the costs for your repairs before any work begins.

Too often, policyholders are pressed to get started with their repairs, assured they can simply add changes to their claim as work progresses. Most who go this route end up frustrated and short on money as the scope creeps out.

Providing a proper scope of loss is one of the many valuable things our public adjusters do to make sure policyholders are fully compensated for their insured losses.

Determining the full value of your property damage insurance claim takes time and effort. For your home or building(s), this means soliciting and understanding the details of multiple bids — the one your insurer compiles, and those you request from contractors you trust. You are not required to hire contractors recommended by your insurance carrier, even if they promise to work at a lower cost. Construction is a very price competitive trade. Significant differences in estimates usually mean significant differences in materials, craftsmanship, and/or warranty. Be diligent in reviewing bids and selecting the contractor you believe will do quality work at a fair value.

For your personal property, valuation can be challenging. Few policyholders keep a personal property inventory, leaving them to try to recall everything they owned, when they bought it, and how much they paid for it.

In addition to inventorying your personal property, you’ll have to determine whether each item was damaged or destroyed, and its value at the time of loss. It's important to be diligent in making these determinations, as it bears directly on how your claim pays out.

Miller Public Adjusters’ reputation for proving full and fair valuation is one of the things that set us apart from other public adjusters. Our in-house personal property team thrives on getting policyholders every dollar they’re entitled to under the terms of their property insurance policies.

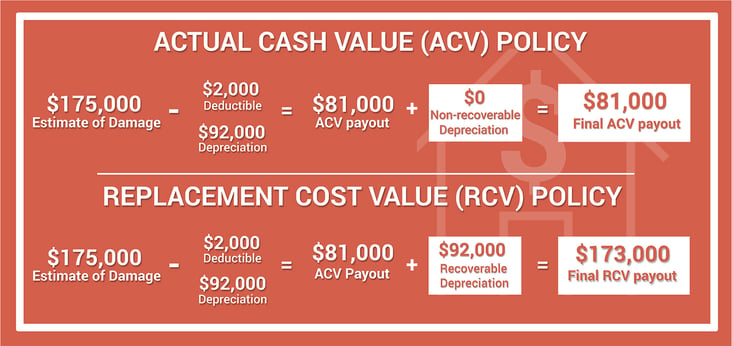

Most property insurance policies pay for damages, first, on an Actual Cash Value (ACV) basis. This means you receive payment for the replacement value of your damaged property — that is, the cost to replace what was damaged with new property of like kind and quality — less depreciation.

Of course, defining depreciation is more art than science. Your insurance company’s claims adjuster uses standard depreciation tables that reduce valuation of personal property by a given percentage each year. These tables do not take into account how your property was used, cared for, etc. For example, a $5,000 leather sofa in a formal living room that no one uses should not depreciate at the same rate as a discount store futon used in a playroom.

Negotiating fair ACV valuation requires a detailed inventory, a proper determination of which items were damaged vs. destroyed, and exhaustive research.

If you have Replacement Cost Value (RCV) coverage, once you replace your damaged property, you submit your receipts for reimbursement of the difference between the ACV payment you received and what you paid to replace your property with new property of like kind and quality. Always be sure to save all your receipts for any purchases related to your claim.

ACV and RCV are areas where policyholders are routinely underpaid for their damages. Some reasons for this include:

Some policies split the ACV/RCV hairs even thinner with provisions like, “functional replacement cost,” which means your repairs are covered only to the extent that the replacement functions as intended. For example, if your hardwood floors are water damaged, you could be compensated for the cost of laminate as a functional replacement. To replace your floors with hardwood would require you to pay the difference out of pocket.

At the other end of the spectrum is “guaranteed replacement cost,” which pays to replace damaged property at RCV, even if the total cost exceeds the policy limit.

The various types of ACV and RCV coverage illustrate just some of the many differences in policy language. These differences are why it’s so important to understand the provisions in your policy.

When severe property damage displaces you from your home, your homeowners insurance policy may cover the extra expenses you incur. Temporary housing, increased food bills, added travel, animal boarding, storage, and many other claim-related costs can be reimbursed through your Additional Living Expenses (ALE) coverage.

For some of your expenses, like temporary housing, your insurance company may pay the bill directly. Keep records of those expenses, and save receipts for any expenses you pay out of pocket. Download our free ALE Worksheet to track your ALE like a pro.

Limits on ALE can be set at a dollar amount or a time limit. Check your policy.

If damage to your commercial property causes business interruption losses, the smartest move you can make is to consult with a licensed public adjuster with experience in business operations and forensic accounting.

Business interruption claims are complex and can grow contentious quickly. There are strict time limits at play, and the burden of proof — placed squarely on the policyholder — is enormous. Few commercial property owners have the property claims expertise necessary to settle business interruption claims for their full value.

Your homeowners or commercial insurance policy may or may not require you to submit a formal Proof of Loss statement. Either way, you still need to determine your own claim value and negotiate for a full settlement. Allowing your insurance company to determine your claim value for you is a near-certain path to being underpaid for your damages.

Every step you take throughout your commercial or homeowners insurance claims process predicts the outcome of your settlement. From understanding how to use your insurance policy, to meeting your contractual obligations, documenting your damages, and proving the full value of your loss, the path to recovery can be a long climb up a steep mountain.

From low-ball settlement offers to the widespread practice of, Delay, Deny, Defend, policyholders have many legitimate reasons to dispute their insurers' interpretations of their property damage insurance claims.

Your policy, as well as your state's regulations and laws, provide remedies to any valid commercial or homeowners insurance claim dispute, whether for coverage, cause, or the value of damages. This is not to say that any valid dispute will be resolved in favor of one party or the other, but that there are processes in place that you can follow in your effort to resolve a dispute.

If you have coverage concerns, the best solution is to show your insurance company's representative the words in your policy that promise coverage. If your insurer says an exclusion applies, read the exclusion carefully and confirm the applicable language matches your circumstances exactly. If it does not match exactly, the rules say coverage is presumed.

Valuation disputes sometimes can be resolved by providing additional proof for the value of your damages. This can be anything from a more detailed scope of loss, to photographs that show you took meticulous care of your personal property, to receipts or comparative research that proves higher valuation is warranted.

Some claim disputes advance to mediation, where the policyholder and insurer negotiate their differences with the aid of a mediator.

When valuation disputes cannot be resolved, either for the value of your damages or the scope of your loss, you or your insurer can invoke the right to appraisal. When a claim goes to appraisal, the value of the claim is established. The decision requires court action to override.

Every state has an insurance commissioner, whose job is to oversee the insurance industry and how it services its customers — you, the policyholder. If you've done everything you can to resolve a dispute with your carrier over your property insurance claim, contacting the commissioner's office in your state could trigger a review.

The insurance commissioner's office is also where you can file a formal complaint against your insurance carrier.

Hiring a public adjuster for insurance claims helps you protect your payout. It also avoids costly mistakes an...

A licensed public adjuster helps you deal with your insurance company and fights for a fair payout. Choose the...

The fastest way to maximize your insurance claim is to work with a public adjuster. Instead of struggling thro...

E-mail address

Contact us

Money-back

600 S Nicolet Rd. Suite A

Appleton, WI 54914