Late in the evening of Monday, Jan. 26, winter storm Juno -- the so-called "snowpocalypse" -- roared through some of the most populated areas of the northeastern U.S., crippling cities like Boston and Philadelphia.

The storm brought several feet of snow to certain areas, damaging thousands of homes in the process, the Wall Street Journal reports.

Homeowners looking to file storm-damage claims might shudder with memories of Hurricane Wilma, which struck Florida in October 2005 and resulted in notorious delays for Florida homeowners hoping to file flood damage claims. More than four years after Wilma, as many as 2,000 homeowners who didn't enlist the help of Florida public adjuster services were still waiting on their claims.

And while those in the northeast might not have quite as long a wait for their insurance claims to clear, there are still a few things you should do to ensure that you get your storm-damage claim filed in a timely manner:

Contact your insurance company as soon as possible

It's common for many homeowners to hesitate when making the initial call to their insurance providers, as they aren't certain if their homes are damaged enough to necessitate a claim. However, don't let this type of thinking bog you down -- call your insurance company as soon as you know your property has been damaged. With every minute you wait, you'll be putting yourself behind hundreds of others who have made the call before you. And don't worry about your insurance policy being negatively impacted -- most states forbid insurance companies to cancel their customers' coverage or increase their rates due to them filing an Act of God claim.

Seek out the help of a qualified public adjuster

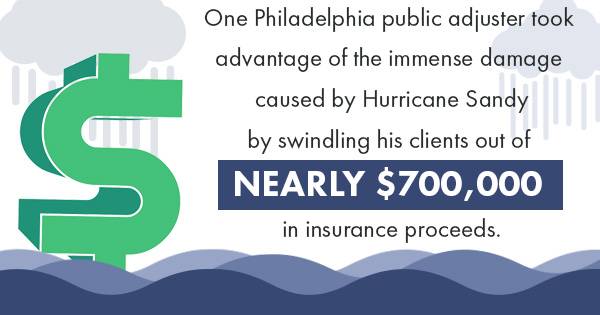

Public adjusters provide a crucial service to homeowners like you who are seeking out a storm-damage claim. They can help you convey the severity of the damage that has been done by the winter storm to your insurance company. In addition, hiring your own public adjuster to work with the one your insurance company provides can help make your claim process more complete and expedited.

Provide accurate information regarding the damage to your home

Public adjuster services only work if you're completely honest with your public adjuster about the state of your home. Be sure to provide your public adjuster with things like before and after photos of your house, purchase records and even contractor estimates for the cost of repairing your home's damage. This makes the job easier for your public adjuster and helps speed up the claim process even more.

Want to know more about how public adjuster services can help you expedite your flood, storm and fire damage claims? Call the number above or visit our contact page.

.png?width=190&height=55&name=MPA%20Logo%20Vector%20-%20Original%20(3).png)

.webp?width=331&height=382&name=ResourcesCTA-Fin-001%20(1).webp)