When it comes to understanding insurance coverage there are numerous terms and language that most policyholders are unfamiliar with. These include Indemnity, Actual Cash Value (ACV), Replacement Cost Value (RCV) and Depreciation.

What is ACV(Actual Cash Value)?

The term "actual cash value" is not as easily defined. Some courts have interpreted the term to mean "fair market value." Most courts, however, have upheld the insurance industry's traditional definition: the cost to replace with new property of like kind and quality, less depreciation.

What is RCV(Replacement Cost Value)?

The term "replacement cost value" is typically defined or explained in the policy stating the cost to replace the damaged property with the same like kind and quality without the deduction of depreciation. This value is stated to replace in today's market conditions to bring insured back to pre-loss conditions.

What is Depreciation?

Depreciation is the loss of value from all causes such as age, wear and tear, and deterioration.

What is Indemnity?

Indemnity is probably the most basic and fundamental principle of property insurance. The basic purpose of insurance is to cover a loss that you have suffered. Indemnity is the payment for that loss by the insurer (insurance company) to the insured (you), but for no more than the actual amount of the loss. This allows your property to become “whole” again, meaning the property is restored as it was five minutes before the loss. Indemnity compensates the insured for the loss, but does not allow the insured to make a profit.

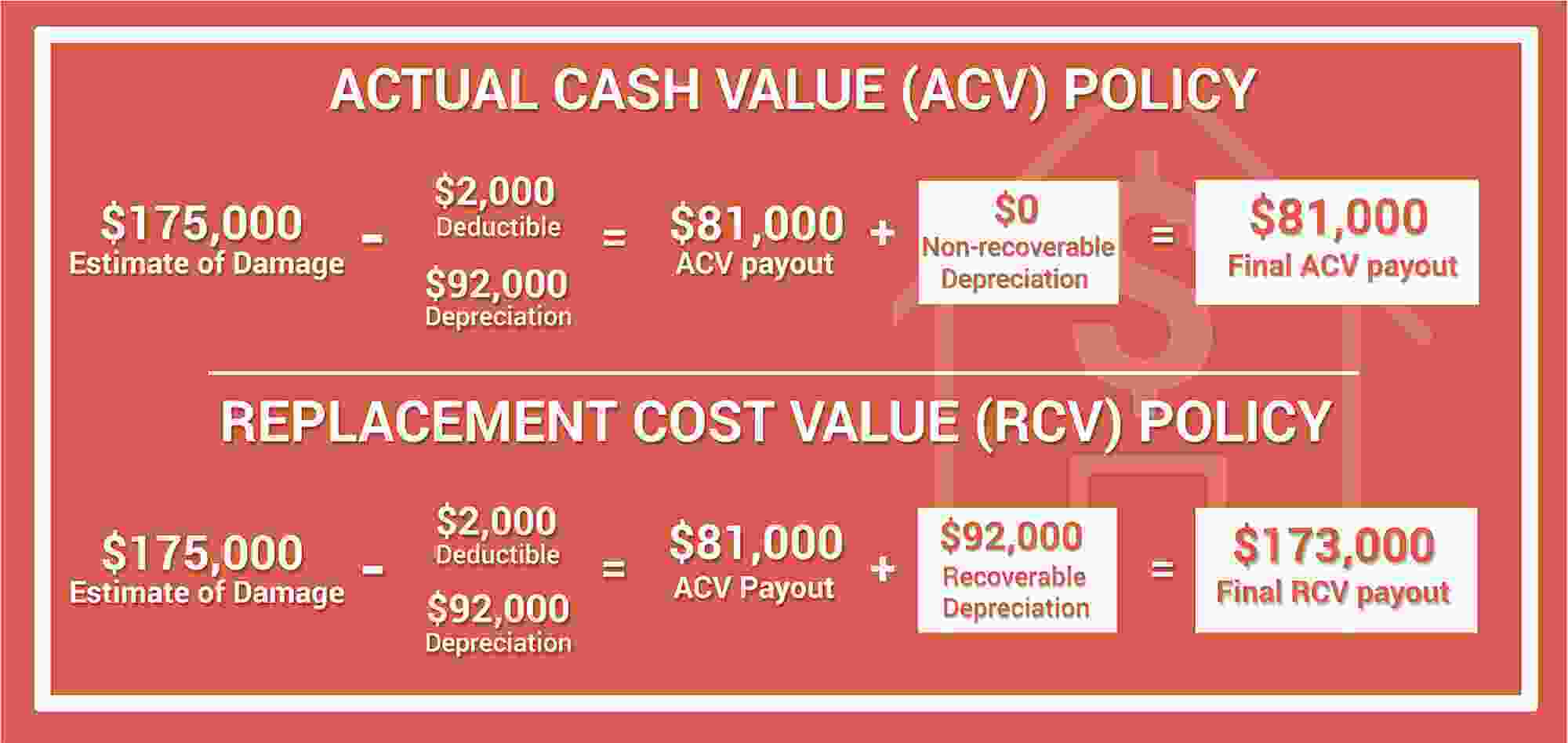

An Example of how ACV, Depreciation, and RCV come into play.

Most insurance policy's have language similar to the one below.

“We will pay the cost to repair or replace with similar construction and for the same use on the premises, subject to the following: until actual repair or replacement is complete, we will pay only the actual cash value at the time of the loss of the damaged property.”

Let's say you have a replacement cost value policy and a tree falls and lands on your house and damages your roof. Your roof is 10 years old. Your insurance company is entitled to pay for the damaged items and make you "whole" again. They will take the age of your roof into factor and give you an initial check for the ACV(Actual Cash Value) to replace the damaged roof. Once you hire a contractor and replace the roof, your insurance company will give you the depreciation they held back initially and the check will allow you to collect the full RCV(Replacement Cost Value) of your damaged roof.

In short, Actual Cash Value = Replacement Cost – Depreciation. Hiring and licensed and experienced Public Adjuster will help ensure you receive the highest settlement possible for you insurance claim settlement.

.png?width=190&height=55&name=MPA%20Logo%20Vector%20-%20Original%20(3).png)

.webp?width=331&height=382&name=ResourcesCTA-Fin-001%20(1).webp)