When is The Right Time for the Appraisal Clause? Are you at a settlement impasse with your insurance company? ...

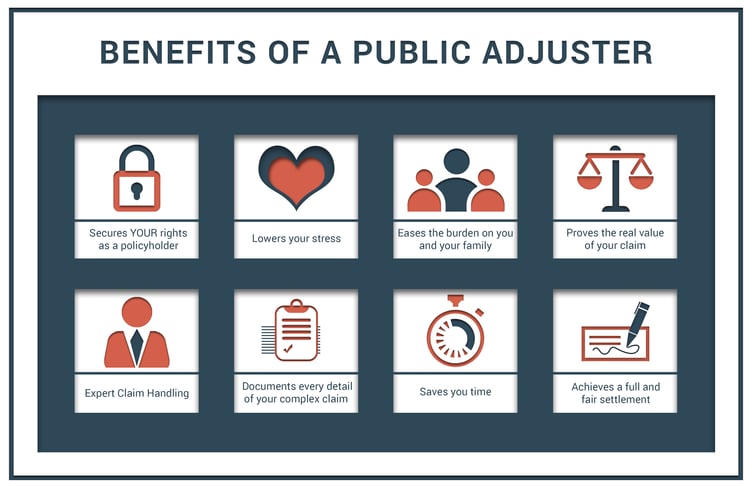

Residential and commercial insurance claims are complex. The larger the loss, the harder it is for a policyholder to achieve a fair settlement. There’s just too much involved. This is where an experienced public adjuster delivers real value, by knowing exactly what needs to happen to get the best results from your property insurance claim. Our public adjusters:

Achieving all of this within the time frames defined in your policy is no small task, especially if you’re dealing with a large loss. That’s why Miller Public Adjusters has on-staff estimators, loss consultants, personal property specialists, and other insurance professionals all supporting the public adjusters. No detail is overlooked. Click here to meet the Miller team.

Everyone says, “yourclaims adjuster,” but the adjuster your insurance company assigns to your claim istheirclaims adjuster. Whether he or she is employed directly by the insurance carrier, or is an independent adjuster under contract with the insurance carrier, the claims adjuster your insurance carrier sends does not work for you. Rather,theirclaims adjuster’s job is to guide you throughtheirprocess — a process designed to reduce claim costs and bolster profits.

Public adjusters are the only insurance claims adjusters who represent and advocate exclusively for commercial and homeowners insurance policyholders.

Sorry, but no. When you’ve suffered an insured loss, your insurance company only has to pay you as much, or little, as they can persuade you to walk away with.

Assumed in your policy is your obligation to prove the full extent of your damages. Certainly, your insurance carrier will take on the task of processing your claim. And they will make a settlement offer. It may even appear to be an iron-clad, computer-generated, scientific calculation that was drawn from software that’s updated all the time.

Don’t be fooled:

Your claim value is likely to change substantially when tallied by a public adjuster working in your best interest. See our client stories for real-life examples.

Like all professions, some public adjusters are better than others. When selecting the public adjuster best qualified to manage your claim, look for a licensed public adjuster with a proven track record showing they are successful:

Insurance Claims and Policy Experts

It’s easy to talk about property insurance claims like they all follow a clear path that leads straight to the right outcome. After all, a successful settlement is won on the policyholder’s ability to prove just three things:

Any suggestion that proving these things is easy, or that a computer can do it for you, is false. Claims get messy in a hurry, usually because the:

Experienced public adjusters study policies and work on property insurance claims every day. They’re experts at interpreting policy language, overcoming coverage concerns, identifying every promise of coverage, and determining the best way to apply your coverages to maximize your settlement award.

Buildings and Personal Property Experts

A full and fair settlement for your damages begins with a thorough scope of loss. That means knowing where to look and what to look for to identify the extent of damage to your home or building(s). It also means knowing how to present a demand for the fair value of those damages in accordance with your policy.

Put a skilled public adjuster on your claim, and the risk of a low settlement offer is erased by deep experience with:

Business Loss Experts

When severe property damage leads to lost income, business interruption, relocation, and other extra expenses, the smart move is to get a claims expert on your side immediately. The complexities in these claims grow exponentially, often leaving commercial policyholders unfairly subsidizing their insured losses. A public adjuster can:

Negotiation Experts

Negotiating your insurance claim settlement is a process that begins when you notify your insurance company of your loss. Immediately, you are sized up for what you know and say about your damages, how much you know about your policy, and if you are looking to your insurance carrier or agent for guidance with your claim.

A public adjuster breaks that assessment cycle, stepping in as your exclusive professional representative. With a level playing field, abundant documentation, and verifiable proof of all valuations, it becomes very hard for the insurance company to argue for anything less than a full and fair settlement.

Claim disputes are common. There’s much at stake, and the deck is stacked against the policyholder. It’s easy for emotions to run hot, especially when you’re the one with everything to lose. If brought in early, a licensed public adjuster will head off most claim disputes.

When a dispute does arise, an experienced public adjuster will know exactly what to do to resolve the problem as efficiently as possible. Sometimes it’s as easy as providing an explanation or additional documentation. Other times, it’s as challenging as knowing when to invoke appraisal or recommend the policyholder pursue a bad faith lawsuit.

If you’re currently involved in a dispute over your claim, a public adjuster may be just the person to get you back on track to a successful settlement. Some common claim disputes that public adjusters can resolve include:

Until you’ve agreed to a final settlement for your commercial or homeowners insurance claim, there’s still time to get an expert claim review.

Hiring a public adjuster is not an appropriate choice for every property insurance claim. A few instances when a public adjuster would not add value to either a commercial or homeowners insurance claim include:

For more about why hiring a public adjuster may or may not be your best choice — including important questions to ask before you choose a public adjuster — please visit ourblog.

An experienced property claims attorney is the right choice if your insurance claim has gone so far off the rails that you need to file a lawsuit against your insurance company. Until then, an attorney can’t do much more than draft a letter and request that your insurance carrier comply with the terms of your policy.

A public adjuster, however, serves as your exclusive advocate at every stage of your property insurance claim process. When handled by a licensed claims professional, most homeowners and commercial insurance claims can be settled successfully and without the need to file suit.

If you’re wondering whether an attorney or a public adjuster is the right choice to achieve the maximum settlement available for your claim,this article from United Policyholders, a non-profit policyholder advocacy group, will help clarify the questions you should ask, fees you can expect to pay, and options you may not have considered.

Public adjusters generally charge a 10 percent fee based on the total settlement achieved for the policyholder. While rare, some special circumstances allow for higher or lower fees. It’s important to clarify up front exactly what a public adjuster will charge to manage your claim. It’s equally important to ask about the value he or she will deliver for that fee. Miller Public Adjusters will not take on a claim unless we can add substantial value for the policyholder.

It is common practice for your public adjuster to become a signed payee on your insurance claim checks. That means any checks sent by your insurance company will be made out to you and your public adjuster. If you have a mortgage, the lien holder also will be a payee, as will any other parties with insurable interests.

This expert’s guide will take you through the steps to manage your insurance claim from start to finish and help you maximize the settlement.

When is The Right Time for the Appraisal Clause? Are you at a settlement impasse with your insurance company? ...

There’s more to fire damage than meets the eye. Fire can also cause hidden damages that can be hard to detect....

Building codes are in a constant state of evolution. Advancements in engineering, technology, safety, building...

E-mail address

Contact us

Money-back